A forex broker is a financial services company that provides access to the forex market. The popular forex brokers tend to be those with a license, a low-cost account option, and a good reputation. The forex market has experienced significant growth in recent years, attracting traders from across the world. As interest in currency trading increases, several forex brokers have become popular among traders.

This article examines some of the most prominent brokers catering to the forex market and their key features. Here are our list of the most popular forex brokers.

Broker | Review | Review | Visit |

* 1:1000 leverage * 210+ instruments * Free education | |||

* 1:1000 leverage * 950+ instruments * Copy trading | |||

*1:500 leverage | |||

* 1:500 leverage * 390 instruments |

Contents

Understanding the Global Forex Market

Before we look into specific brokers, it’s crucial to grasp the unique characteristics that define the forex market. These factors, such as the regulatory environment and market potential, significantly influence the trading landscape.

Regulatory Environment

The regulatory landscape for forex trading varies significantly from country to country. Some nations have well-established financial regulatory bodies, while others are still developing their frameworks. Traders should always verify a broker’s regulatory status before opening an account.

Market Potential

The global forex market is increasing, driven by factors such as:

- Increasing internet penetration

- Rising smartphone adoption

- Growing interest in financial markets among the young population

- Economic development in many countries

Top Forex Brokers Popular

Let’s examine some forex brokers that have gained popularity among traders.

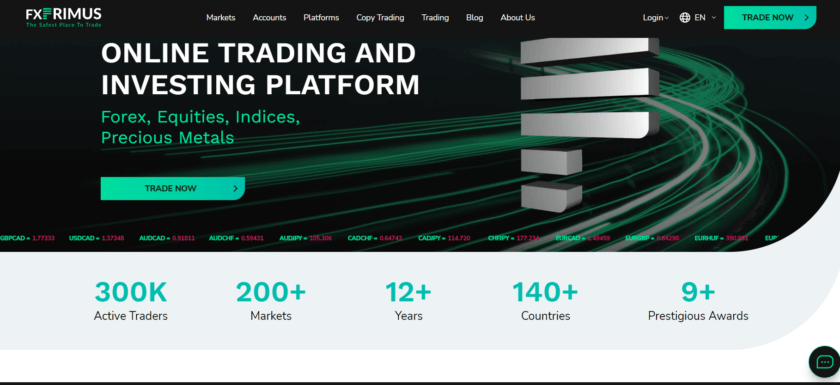

FXPrimus

FXPrimus has established itself as a trusted name in the forex scene. Known for its claim to be “The Safest Place to Trade,” FXPrimus offers:

- High leverage of up to 1:1000

- Over 210 trading instruments

- Free educational resources

These features make FXPrimus an attractive option for novice and experienced traders.

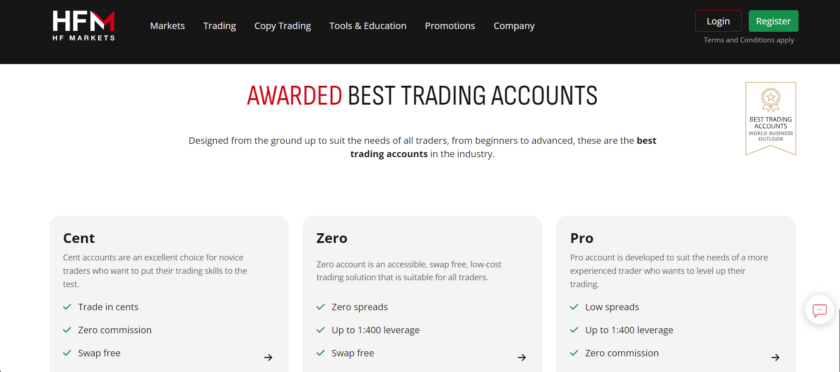

HFM

HFM has gained significant traction in the market, offering:

- Leverage up to 1:1000

- Over 1200 trading instruments

- Tight spreads

HFM’s comprehensive platform and competitive offerings have helped it build a strong reputation among forex enthusiasts.

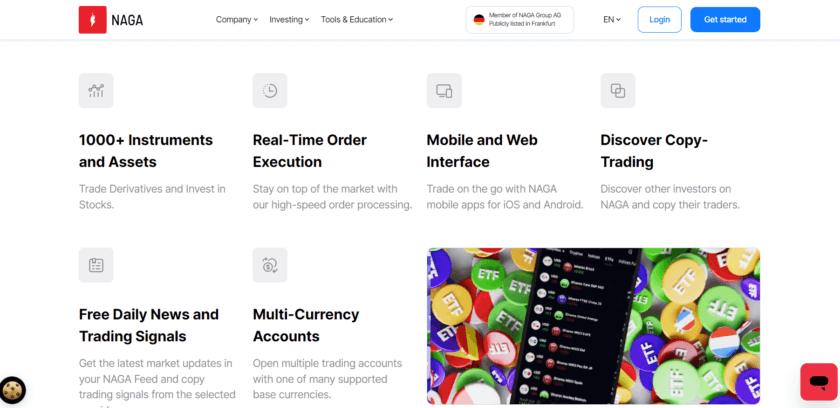

NAGA

NAGA has made significant inroads in the forex trading community by providing:

- High leverage of 1:1000

- More than 950 instruments

- Copy trading feature

NAGA’s social trading aspect has proven popular among traders looking to learn and grow their skills.

Key Factors Contributing to Broker Popularity

Several factors contribute to a forex broker’s popularity among traders:

Regulatory Compliance‼

One key factor contributing to a forex broker’s popularity among traders is regulatory compliance. Reputable brokers are regulated by recognized authorities, providing traders with a sense of security and trust. This compliance ensures that brokers adhere to strict financial standards and protect client funds, which is crucial in building long-term confidence in the forex market.

Low Minimum Deposits 💸

Many traders prefer brokers offering low minimum deposits, allowing them to start trading with small amounts of capital. This accessibility is essential in regions with lower average incomes, enabling a broader range of individuals to participate in forex trading.

Educational Resources📚

Brokers providing comprehensive educational materials, webinars, and seminars are highly valued by traders looking to improve their skills. These resources play a vital role in developing a knowledgeable trading community and help mitigate the risks associated with forex trading in emerging markets.

Mobile Trading Platforms📱

With the high smartphone penetration today, brokers offering robust mobile trading platforms are increasingly popular. Mobile accessibility allows traders to manage their positions on the go, which is essential in a continent where many rely primarily on mobile devices for internet access.

Challenges and Considerations for Forex Traders

While the forex market offers opportunities, traders face unique challenges:

Currency Restrictions

Some countries, such as Nigeria, have strict currency control regulations, which can complicate deposits and withdrawals. These restrictions can also impact the ease of transferring funds to and from forex trading accounts, requiring traders to be well-informed about their local financial laws. In Nigeria, strict foreign exchange policies implemented by the Central Bank of Nigeria (CBN) significantly impact forex traders.

Nigerian traders face limits on the amount of foreign currency they can purchase or transfer out of the country, and they may be required to provide additional documentation when moving funds to a foreign forex broker. These restrictions can make it challenging for Nigerian traders to deposit or withdraw large sums from international trading accounts, often necessitating specific approved payment methods or splitting transactions into smaller amounts to comply with regulations.

Internet Connectivity

While reliable internet access is crucial for forex trading, it can be inconsistent in some regions. This inconsistency can lead to missed trading opportunities or difficulty in managing open positions. Therefore, brokers need to offer platforms with offline capabilities or low-bandwidth options to ensure uninterrupted trading.

Payment Methods

Not all international payment methods are widely available in every country, so brokers offering local payment options are often preferred. The availability of familiar and accessible payment methods increases trust and reduces barriers to entry for traders, making it a key consideration in broker selection.

The Future of Forex Trading

The forex market is poised for continued growth. Factors driving this trend include:

- Increasing financial literacy

- Improving regulatory frameworks

- Growing economic opportunities

- Technological advancements

As the market matures, we expect to see more brokers tailoring their services to traders’ needs.

Bottom Line

The popularity of forex brokers is driven by a combination of factors, including high-leverage options, a wide range of trading instruments, and educational resources. As the forex market evolves, traders should carefully consider these factors when choosing a broker. Remember, while this article highlights some popular brokers, traders must conduct their own research and choose a broker that aligns with their individual trading goals and circumstances. When selecting a forex broker, always prioritize safety and regulatory compliance.

FAQ

When selecting a forex broker, consider their regulatory status, trading platform quality, range of available instruments, spread and fee structure, customer support quality, educational resources, and deposit/withdrawal options.

A broker’s regulatory status is crucial. Regulated brokers must adhere to strict financial standards, protect client funds, and maintain transparent operations. Always verify a broker’s regulatory status with the relevant financial authorities.

Fixed spreads remain constant regardless of market conditions, offering predictability in trading costs. Variable spreads fluctuate based on market liquidity and volatility, potentially offering tighter spreads during normal market conditions but widening during high volatility.

Leverage allows traders to control larger positions with a smaller amount of capital. For example, 100:1 leverage means you can trade positions worth $100,000 with just $1,000 in your account. While this can amplify profits, it also increases potential losses.

Leverage allows traders to control larger positions with a smaller amount of capital. For example, with 100:1 leverage, traders can trade positions worth $100,000 with just $1,000 in their account. This amplifies profits but also increases potential losses.