| 🏛️ Based in | Limassol, Cyprus |

|---|---|

| ⚖️ Regulation | CySEC, FSA |

| 💰 Minimum Deposit | $5 |

| 💳 Deposit Options | VISA, MasterCard, Bank Wire, Skrill, Neteller, or Webmoney. |

| 💳 Withdrawal Options | VISA, MasterCard, Bank Wire, Skrill, Neteller, or Webmoney. |

| 📌Open an account | Start Trading with easyMarkets |

Contents

- 1 Our Opinion About easyMarkets

- 2 Regulation

- 3 easyMarkets Forex Broker Review: Legit or Scam?

- 4 easyMarkets Trading Instruments

- 5 easyMarkets Account Types

- 6 Trading Tools

- 7 easyMarkets Leverage, Spread and Commissions

- 8 easyMarkets Deposits and Withdrawals

- 9 easyMarkets Registration – How To Open A Trading Account

- 10 easyMarkets Bonuses and Promotions

- 11 easyMarkets Trading Platforms

- 12 easyMarkets Education and Research

- 13 easyMarkets Customer Support

- 14 Our Verdict

- 15 FAQs

- 16 Similar Brokers

Our Opinion About easyMarkets

easyMarkets has established itself as a noteworthy player in the global forex trading landscape, offering services that cater to the diverse needs of traders worldwide. With a history spanning over two decades, easyMarkets brings a wealth of experience to the table, which is particularly valuable in today’s dynamic forex markets. For traders around the globe, easyMarkets presents an attractive package combining competitive trading conditions, a user-friendly platform, and a range of educational resources. According to our easyMarkets review shows that the broker’s low minimum deposit requirement of just $25 makes it accessible to many traders, including those new to the forex market.

One of the standout features of easyMarkets is its commitment to transparency. The broker offers fixed spreads and no slippage on its proprietary platform, which can be particularly beneficial for traders who may be concerned about unexpected costs or price movements during volatile market conditions. easyMarkets also provides a suite of risk management tools, including the unique dealCancellation feature, which allows traders to cancel a losing trade within a certain timeframe for a small fee. This can be especially useful for traders who are still developing their strategies and want an extra layer of protection against market volatility.

Regulation

easyMarkets operates globally through various subsidiaries, with its main entity regulated by the Cyprus Securities and Exchange Commission (CySEC). While this provides a solid regulatory foundation, traders should be aware that protection levels may vary based on their location and the specific easyMarkets entity they’re dealing with.

The broker implements robust client fund protection measures across all subsidiaries, including fund segregation, negative balance protection, and regular audits. However, it’s crucial for traders worldwide to conduct thorough due diligence and understand the regulatory implications specific to their region before engaging with easyMarkets.

easyMarkets Forex Broker Review: Legit or Scam?

easyMarkets has established itself as a legitimate forex broker, evidenced by its two-decade-long presence in the industry, FSC regulation, transparent operations, and positive user feedback from African traders. The broker’s industry recognition, including awards and implementation of advanced security measures further bolster its credibility. However, while these factors suggest reliability, African traders are advised to conduct their own due diligence and start with a small deposit to personally evaluate the broker’s services before making substantial commitments.

easyMarkets Trading Instruments

easyMarkets offers a diverse range of trading instruments, catering to the varied interests of global traders:

- Forex: Over 100 currency pairs, including major, minor, and exotic pairs.

- Cryptocurrencies: 6 major cryptocurrencies including Bitcoin, Ethereum, and Litecoin.

- Commodities: 12 commodity CFDs including gold, silver, oil, and agricultural products.

- Indices: 15 global index CFDs, providing exposure to major markets worldwide.

- Stocks: 50 CFDs on shares of major US, European, and Australian companies.

- Precious Metals: 19 precious metal CFDs, offering opportunities beyond traditional gold and silver trading.

This wide array of instruments allows traders to diversify their portfolios and take advantage of various market conditions.

easyMarkets Account Types

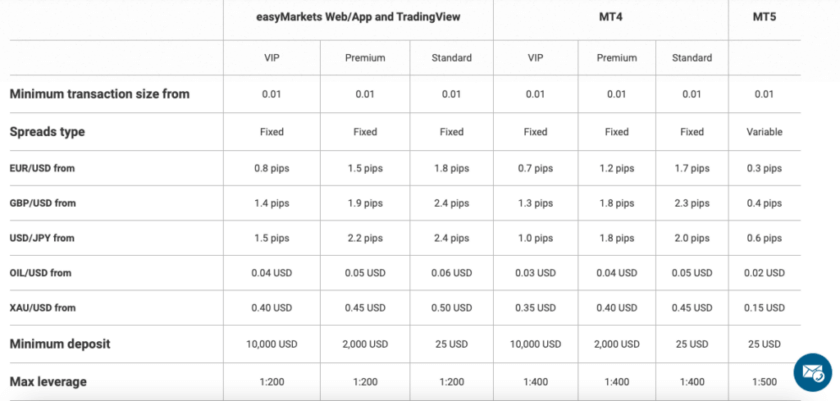

easyMarkets offers three main account types, each catering to different levels of trading experience and capital:

Standard Account

- Minimum Deposit: $25

- Spreads: From 1.8 pips (WebTrader) or 1.7 pips (MT4)

- Commissions: No commission

- Leverage: Up to 1:500

- Ideal for: Beginner traders or those with limited capital

Premium Account

- Minimum Deposit: $2,000

- Spreads: From 1.5 pips (WebTrader) or 1.2 pips (MT4)

- Commissions: No commission

- Leverage: Up to 1:500

- Ideal for: Intermediate traders with more capital and experience

VIP Account

- Minimum Deposit: $10,000

- Spreads: From 0.8 pips (WebTrader) or 0.7 pips (MT4)

- Commissions: No commission

- Leverage: Up to 1:500

- Ideal for: Experienced traders with significant capital

Each account type is available on both the proprietary easyMarkets WebTrader platform and the popular MetaTrader 4 (MT4) platform, giving traders flexibility in their choice of trading interface.

Trading Tools

easyMarkets provides several unique trading tools:

- dealCancellation: Allows traders to cancel a losing trade within a specified timeframe for a small fee.

- Freeze Rate: Allows traders to freeze the price they see for a few seconds, giving them time to place a trade without worrying about sudden price movements.

- easyTrade: Allows traders to set a fixed amount they’re willing to risk on a trade, simplifying risk management.

- Technical Analysis Tools: A range of technical indicators and charting tools for in-depth market analysis.

- Economic Calendar: Keeps traders informed about upcoming economic events that could impact the markets.

These tools, combined with the educational resources provided by easyMarkets, can significantly enhance the trading experience for traders at all levels of expertise.

easyMarkets Leverage, Spread and Commissions

easyMarkets offers competitive trading conditions:

Leverage: Up to 1:500 across all account types. While this high leverage can amplify profits, it also increases risk. Traders should use leverage cautiously and understand its implications.

Spreads: Vary depending on the account type, ranging from 0.7 pips to 1.8 pips on major pairs.

Commissions: easyMarkets operates on a no-commission model across all account types.

easyMarkets Deposits and Withdrawals

easyMarkets offers a variety of deposit and withdrawal methods:

It’s important to note that while easyMarkets doesn’t charge fees for deposits or withdrawals, intermediary banks or payment providers might apply their own fees.

easyMarkets Registration – How To Open A Trading Account

Opening an account with easyMarkets is a straightforward process:

- Visit the easyMarkets website and click on “Open Account” or “Start Trading”.

- Fill in the registration form with your personal details.

- Choose your account type (Standard, Premium, or VIP).

- Verify your identity by providing necessary documents (typically a government-issued ID and proof of address).

- Fund your account using one of the available deposit methods.

- Start trading.

easyMarkets Bonuses and Promotions

easyMarkets occasionally offers bonuses and promotions that can be beneficial for traders. These may include welcome bonuses, loyalty programs, risk-free trades, and educational resources. It’s important for traders to carefully review the terms and conditions of any bonus or promotion by easyMarkets.

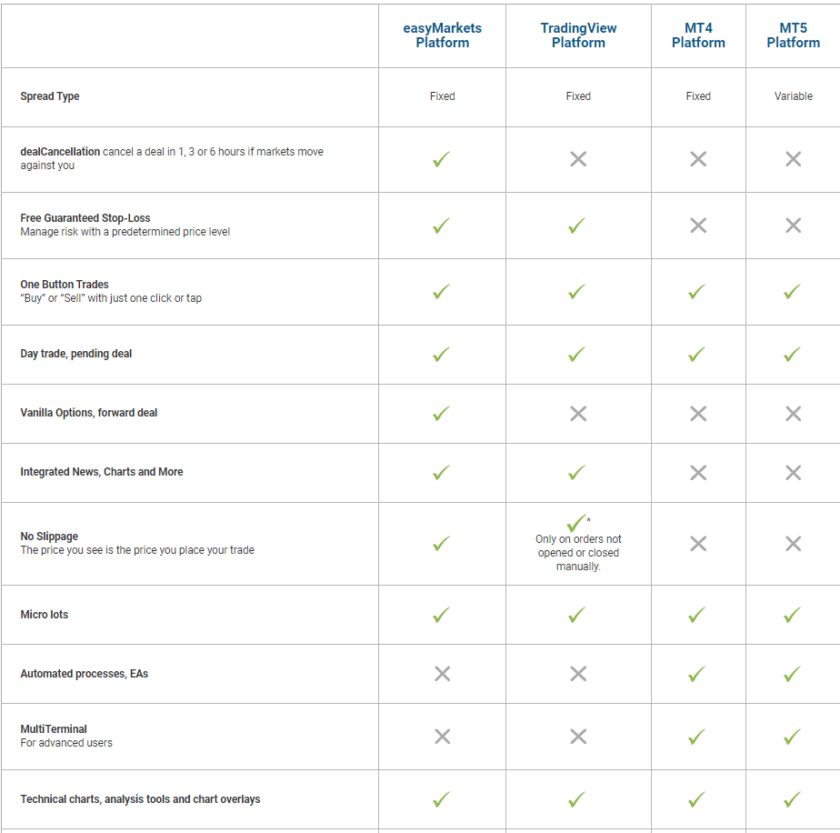

easyMarkets Trading Platforms

easyMarkets offers two main trading platforms:

easyMarkets WebTrader

This is easyMarkets’ proprietary web-based platform, featuring a user-friendly interface, access to unique tools like dealCancellation and Freeze Rate, and real-time charts and technical analysis tools.

MetaTrader 4 (MT4)

MT4 is a popular third-party platform known for its advanced charting capabilities and automated trading features.

easyMarkets Education and Research

easyMarkets provides a comprehensive suite of educational resources and research tools to help traders review. These include; eBooks, video tutorials, webinars, trading courses, an economic calendar, daily market analysis, and technical analysis tools.

easyMarkets Customer Support

easyMarkets offers multi-lingual customer support:

- 24/5 Support: Available via live chat, email, and phone

- Multiple Languages: Support is offered in various languages

- FAQ Section: Comprehensive answers to common questions

- Personal Account Managers: Available for VIP account holders

Our Verdict

easyMarkets presents a solid option for global traders looking for a reliable forex and CFD broker. Its strengths lie in its user-friendly platforms, innovative tools like dealCancellation, and a wide range of educational resources. The low minimum deposit for the Standard account makes it accessible to many traders.

Overall, easyMarkets could be a good choice for traders who value educational resources, innovative trading tools, and a user-friendly platform. As always, our easyMarkets review recommend that traders start with a small deposit, make use of the educational resources, and thoroughly understand the risks involved in forex trading.

Like what you see? Sign up for an online trading account with easyMarkets here.

FAQs

easyMarkets provides 24/5 customer support via live chat, email, and phone in multiple languages. They also offer personal account managers for VIP account holders.

easyMarkets stands out with its unique features like dealCancellation and Freeze Rate. However, traders should compare multiple brokers, considering factors like regulation, trading conditions, and platform features before making a decision.

Yes, easyMarkets’ WebTrader platform and educational resources make it suitable for beginners. However, all traders should educate themselves about the risks involved in forex trading.

Similar Brokers

Looking for more options? Take a look at our other forex broker reviews.