Disclaimer: Trading CFDs with FXPro involves significant risk. Approximately 72.99% of retail investor accounts lose money with this provider. Ensure you understand how CFD’s work and if you can afford the potential losses before trading.

Contents

- 1 FXPro Basics

- 2 Our Opinion About FXPro

- 3 Regulation And Safety

- 4 FXPro Trading Assets

- 5 FXPro Account Types

- 6 FXPro Registration: How To Open An Account

- 7 FXPro Registration: How To Verify An Account

- 8 FXPro Spreads

- 9 FXPro Commission

- 10 FXPro Deposits

- 11 FXPro Withdrawals

- 12 FXPro Trading Platforms

- 13 Trading Tools

- 14 FxPro VPS Services

- 15 Forex Education

- 16 FXPro Trading Hours

- 17 FxPro Customer Support

- 18 Our Verdict

- 19 FXPro Forex Broker Review FAQ

- 20 Similar Brokers

FXPro Basics

| 🏛️ Based in | Limassol, Cyprus |

|---|---|

| ⚖️ Regulation | CySEC, FCA, FSCA |

| 💰 Minimum Deposit | $100 (40,000 Naira) |

| 💳 Deposit Options | VISA, MasterCard, Bank Wire, AdvCash, Neteller, Skrill, GenialBanco, & more. |

| 💳 Withdrawal Options | VISA, MasterCard, Bank Wire, AdvCash, Neteller, Skrill, GenialBanco, & more. |

| 📌Open an account | Start Trading With FXPro |

Our Opinion About FXPro

Stepping into the realm of online trading is a significant decision, and partnering with FxPro can elevate your experience in ways that stand out in the industry. With a rich history dating back to 2006, FxPro has earned a stellar reputation built on trust and excellence.

FxPro’s global reach is undeniably impressive, with over 2 million clients spanning across more than 170 countries. Its online trading accounts stand out for European traders, providing access to a diverse array of financial markets such as forex, stocks, indices, and commodities.

A closer look at FxPro reveals a brokerage that prioritizes user satisfaction and trading versatility. Their user-friendly platform, coupled with competitive spreads and a diverse range of assets, offers traders a comprehensive toolkit for success. Whether you’re a novice or a seasoned investor, FxPro’s commitment to providing innovative tools, varied account types, and a customer-centric approach makes them a standout choice.

Regulation And Safety

FxPro takes regulation and safety seriously, adhering to stringent oversight from multiple reputable authorities:

- Financial Conduct Authority (FCA): As one of the most respected financial regulatory bodies globally, the FCA ensures that FxPro operates with integrity and transparency in the UK market.

- Cyprus Securities and Exchange Commission (CySEC): Being regulated by CySEC provides an additional layer of oversight, ensuring FxPro’s compliance with European financial regulations.

- Securities Commission of The Bahamas (SCB): FxPro’s regulation by the SCB underscores its commitment to maintaining high standards of financial services and security.

- Financial Services Commission of Mauritius (FSCM): The FSCM’s oversight further strengthens FxPro’s credibility and trustworthiness in the financial markets.

- Saint Kitts and Nevis (KNN): Regulated by KNN, FxPro demonstrates its commitment to providing a safe and secure trading environment for clients.

Regulation in Europe

Forex traders in Europe can register under the FxPro Financial Services Limited, which is authorised and regulated by the Cyprus Securities and Exchange Commission, under licence no. 078/07. As such, traders in Europe can benefit from many important client fund protection measures. For example, FXPro will guarantee that your net equity never falls below 50 percent. They will also guarantee that you benefit from negative balance protection and that your account never goes into debt.

Fund Safety

As a regulated broker, FXPro ensures that it has robust client fund protection policies in place. For example, they operate using segregated accounts. This means that they keep client funds separate from their own company funds. This ensures that FxPro can never try to use client funds for company purposes.

In addition, FXPro seeks out additional external protection policies. For example, FXPro UK Limited is a member of the Financial Services Compensation Scheme (FSCS) and FxPro Financial Services Limited is a member of the Investor Compensation Fund (ICF). This means that, if FXPro ever closes unexpectedly due to bankruptcy, then some of their forex traders will also benefit from additional client fund protection.

FXPro Forex Awards

FXPro has an excellent great reputation with the forex industry. It is a well-established and highly-regarded business. They won over 50 forex industry awards for their services including best forex provider, best forex broker, and best forex trading tools.For example, some of their most recent awards include Best Broker 2021 UK (Ultimate Fintech Awards), Best Forex Provider 2021 (Online Personal Wealth Awards), and Best Trading Platform 2020 (Investors Chronicle & Financial Times).

FXPro: Legit Or Scam?

FXPro is a legit forex broker. They were first launched in 2006 and have been providing forex trading services for many. They operate on a global scale. As a leading brand, FXPro is trusted by traders worldwide and has a large client base in Europe. They are licensed by the best regulatory authorities in the world and abide by the legal guidelines. In addition, FXPro provides great account types, transparent trading conditions, and low trading costs. In our opinion, they are a reliable forex broker.

FXPro Trading Assets

FXPro offers trading on 2000+ different financial assets. They have a wide choice of forex, shares, indices, futures, metals, and energy products.

FXPro Trading Instruments

- Forex: They have many major, minor, and exotic forex pairs.

- Shares: They have major brands such as Meta, Twitter, Google, Tesla, and Apple.

- Futures: They have Future CFDs including commodities, indices and energies.

- Indices: They provide spot trading on the S&P500, the Nasdaq100, and the FTSE100.

- Spot Metals: They provide spot trading on gold, silver, and platinum.

- Spot Energies: They offer different spot energies such as Brent and WTI.

FXPro Account Types

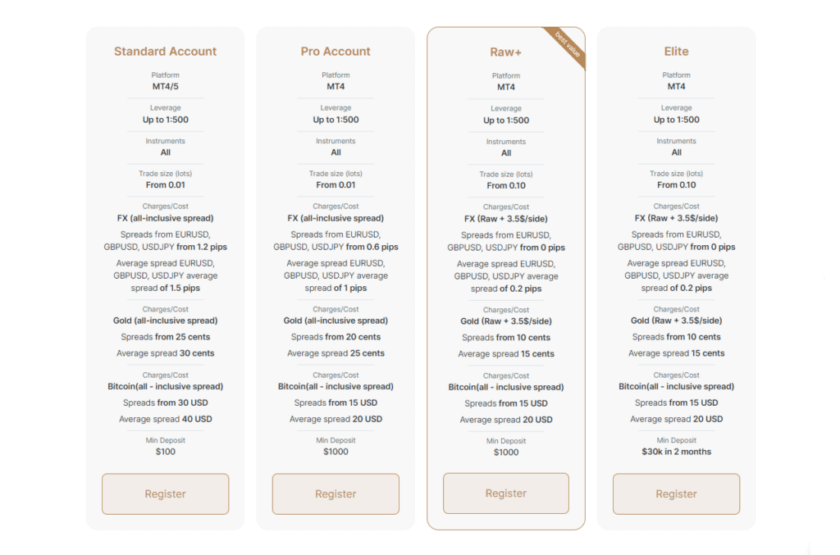

FxPro offers a range of account types to cater to diverse trading needs:

- Standard Account: Tailored for beginners, the Standard Account features fixed spreads and zero commission. This simplicity allows new traders to focus on learning without the complexity of fluctuating spreads.

- Pro Account: Geared towards experienced traders, Pro Accounts offer variable spreads that tighten during high liquidity periods. While there’s no commission, spreads may widen in volatile markets. It strikes a balance between the simplicity of the Standard Account and the advanced features of Raw+ Accounts.

- Raw+ Account: Designed for serious traders seeking minimal spreads, Raw+ Accounts come with a commission but provide raw interbank spreads. This option is ideal for high-volume traders looking to capitalize on minimal price differentials.

- Elite Account: FxPro’s premier offering, Elite Accounts deliver the best trading conditions with ultra-low spreads and commissions. These accounts often include exclusive benefits such as dedicated support, catering specifically to professional and institutional traders.

FXPro Demo Accounts

FXPro has a demo forex trading account for new traders. This is a really helpful resource that can help you get the skills you need to trade successfully. For example, with a demo trading account you can learn how to use your trading tools and try out different forex trading strategies. You can also learn more about how the financial markets work and what forex trading actually involves. The account uses virtual money, instead of real money, and provides a risk-free trading environment.

FXPro Islamic Account

The FXPro provides Islamic swap-free trading versions of their trading accounts.. If you’d prefer to trade using a swap-free version, you can select this option when opening your online trading account. It’s worth taking into account though that additional commission fees may still apply.

Base Currencies

They offer USD, EUR, GBP, JPY, PLN, CHF, AUD,, and ZAR as base currencies.

FXPro Registration: How To Open An Account

As part of our FXPro broker review, we tested their online registration process. If you live in Europe, then you can register for an online trading account with FXPro. The process is quite simple and you can open an account fairly quickly. The first step is to go to their website and complete the online registration form. This is so that they can get your personal details and start creating your account. You also need to provide an email address and password. These will be the login details for your account.

The next step is to take a short forex trading quiz. This is so that they can see what you already know about forex trading and determine if their services are suitable for you. If you pass the test, then you can proceed with your account application. The final step is to complete the KYC (Know Your Customer) process, submit copies of the requested documents, and choose your account type. This is so that FXPro can carry out their regulatory checks and approve your trading account. After that, you can deposit money, using your chosen FXPro payment method, and begin trading.

FXPro Registration: How To Verify An Account

To open a live trading account, you need to go through the KYC process, also sometimes known as account verification process. The KYC process is a legal requirement and enables forex companies to confirm your identity. The process is quite easy. They will ask for a proof of ID and a proof of address. You can send them copies of your National ID card, Passport or Driving License. You can also send them copies of a utility bill or a bank statement registered in your name. After you have verified your account, you can add funds and start trading.

FXPro Spreads

FxPro boasts incredibly tight spreads, starting from 0 pips on select accounts. These tight variable spreads apply to major, minor, and exotic currency pairs, providing traders with competitive pricing across the board. For instance, average spreads can range from 0.6 to 1 pip for pairs like EUR/USD, ensuring cost-effective trading and optimal price execution for FxPro clients.

FXPro Commission

FxPro offers competitive commission structures across its account types, with some accounts featuring zero commissions on forex trades. For accounts that do charge commissions, the rates can be as low as $2 per 100k traded. This translates to approximately $20 round turn for trading one standard lot, showcasing FxPro’s commitment to providing cost-effective trading solutions.

FXPro Deposits

As part of our FXPro broker review, we took a look at what deposit methods you can use to fund an FXPro account.. There are several different deposit options available, which is very convenient.

Deposit Method

You can deposit money using debit card, credit card, and bank wire transfer. You can also deposit money using PayPal, Neteller, Skrill, depending on where in Europe you live. Their deposits are also free of charge, which can help keep non-trading costs down. They process transactions quite quickly, and this makes things easier, especially when you’re opening an account for the first time.

Minimum Deposit

The FXPro minimum deposit is $100 or the equivalent amount in other currencies.

FXPro Withdrawals

As part of our FXPro withdrawal review, we had a look at what withdrawal methods are available. FXPro offers good withdrawal methods and standard withdrawal times.

Withdrawal Methods

FXPro offers several convenient withdrawal methods including debit card, credit card, and bank wire transfer. It also offers other deposit options including PayPal, Neteller, Skrill, depending on your country of residence. The average withdrawal time for a debit card and credit card withdrawal is around 10 minutes. However, the deposit time for bank wire transfers may be longer.

Withdrawal Fees

FXPro does not usually charge withdrawal fees. However, it does have some non-trading fees, which might lead to extra charges. For example, there is usually a fee for withdrawals if you withdraw your money without trading.

FXPro Trading Platforms

FxPro offers a comprehensive suite of trading platforms to cater to diverse preferences. Under the General Manager (GM), clients can select the type of account that best suits their trading style.

- MetaTrader 4 (MT4): Available for desktop (Windows & MAC) through MT4 Desktop, web-based trading via FxPro MT4 WebTrader, multi-account management with FxPro MT4 Multi Terminal, and on-the-go trading with FxPro MT4 Mobile for iOS and Android.

- MetaTrader 5 (MT5): Accessible on desktop (Windows & MAC) with MT5 Desktop and on mobile devices with FxPro MT5 Mobile for iOS and Android.

- cTrader: Empowering traders with advanced features, cTrader is available on desktop through cTrader Desktop, web-based trading via FxPro cTrader Web, and on mobile devices with FxPro cTrader Mobile for iOS and Android.

- FxPro Mobile App: Tailored for iOS and Android users, the FxPro mobile app offers a user-friendly interface for seamless trading on the go.

Trading Tools

FXPro has a large number of free trading tools. On the FXPro trading dashboard, you can find plenty of helpful resources including a currency movers chart, a price ticker chart, and a client position chart. These tools will enable you to look at current price movements and to understand how other traders are approaching the forex market. You can also find a positions volume chart, a price volatility chart, and an economic calendar. These tools will enable you to stay on top of economic data releases and understand how they are impacting the financial markets. On their trading calculator pages, you will also find a free ‘all-in-one’ calculator. This calculator will enable you to plan your trades based on your suggested trading instrument, leverage, and position size.

FxPro VPS Services

FXPro does also have a VPS service. However, this service is only available to a limited number of traders, depending on their account type. The FxPro Virtual Private Server (Forex VPS) enables you to run your MT4 Expert Advisors 24 hours a day. This means you can benefit from more uptime and better overall connectivity, as well as a smoother and faster online trading experience.

Forex Education

As part of our FXPro review, we took at the educational materials and what learning resources they have available for new and intermediate traders. FXPro has several free online courses. Their forex trading courses cover the basic topics and they are great for new traders looking to learn how the market works. There are aslo a few helpful video tutorials that will show you how to register for a trading account, how to verify your profile, and how to deposit money into your account.

FXPro Trading Hours

FXPro operates during standard trading hours. You can open trading positions whenever the forex market is open. Trading hours may be different on public holidays.

FxPro Customer Support

FXPro has a nice customer service team. They are quick to respond and will help you with any questions you have about your account. They are available during working hours, Monday to Friday. You can reach them via email, phone and live chat.

Our Verdict

FxPro is a regulated forex broker. They have great account types and trading conditions, as well as deep liquidity and fast trade execution. They give you the opportunity to trade a wide range of trading instruments, as well as access to some of the top trading platforms in the forex industry. As such, they are a good choice for new traders.

As a licensed forex company, they have a secure online trading environment and have robust client fund protection measures in place . They also have good forex education and helpful trading support. FXPro offers a wealth of learning materials, as well as extensive market research, and useful trading tools. As such, they are a great option for new forex traders in Europe.

FXPro Forex Broker Review FAQ

Yes, FXPro in Europe is a good forex broker. The broker offers plenty of account types and a good range of trading platforms. They also offer access to over 2000 trading instruments including forex, stocks, indices, and commodities. They also offer good trading support and excellent customer service. In our opinion, they are a good broker.

Yes, FXPro is a regulated forex broker. They hold multiple licences from various reputable regulatory authorities. FxPro UK Limited has been regulated by the FCA since 2010. The FxPro Financial Services Limited company has been regulated by CySEC since 2007 and by the FSCA since 2015. FxPro Global Markets Limited is authorised and regulated by the SCB. Forex traders in Europe can register under the CySEC-regulated entity.

Yes, FXPro is a safe broker. They take client fund safety very seriously and operate in line with all their regulatory requirements. They keep client funds in segregated accounts, separate from their operating capital. This means that they can never use client funds for their own operational purposes. They also offer negative balance protection. This means that they can never allow clients balances to fall below zero. In our opinion, FXPro is a trustworthy broker to trade with.

FXPro is one of the best forex brokers in Europe. They offer a reliable online trading service, complete with great trading accounts with low minimum deposits.. They also offer a wide range of trading instruments, trading platforms, and trading tools. However, if you want to have a look at some other options, there are many other great forex brokers as well. We recommend looking at Pepperstone, HotForex, FXTM, and FXPrimus.

Yes, FXPro is a good broker for beginners. They do their best to offer a competitive service with low-cost accounts, and low-cost trading conditions. They also do their best to offer a large selection of trading tools and educational resources.

Similar Brokers

Broker | |||||

Review | |||||

CopyTrading | |||||

Platforms |