| 🔒 Regulations | MISA (Comoros), CySEC (Cyprus), FSCA (South Africa) |

| 🌐 Supported | English, Urdu, Hindi, Indonesian, Portuguese, Thai, |

| Languages | Spanish, Chinese, Vietnamese, Malaysian, German |

| 💰 Products | Currencies, Stocks, Crypto, Indices, Commodities |

| 💵 Min Deposit | $25 |

| 📈 Max Leverage | 1:1000 (MISA), 1:30 (CySEC), 1:500 (FSCA) |

| 💻 Trading Desk | ECN, STP |

Contents

- 1 Our Opinion on Octa

- 2 Regulatory Compliance and Safeguards

- 3 Is Octa a Legitimate Broker?

- 4 Tradable Instruments

- 5 Account Types and Trading Platforms

- 6 Trading Tools and Resources

- 7 Leverage, Spreads, and Commissions

- 8 Deposits and Withdrawals

- 9 Bonuses and Promotions

- 10 Customer Support

- 11 Our Verdict

- 12 FAQ

Our Opinion on Octa

Established in 2011, Octa has earned a solid reputation as a global forex broker. It offers competitive spreads, a diverse range of trading instruments, and compatibility with renowned platforms like MetaTrader 4 and 5. With over 42 million trading accounts opened by clients from more than 180 countries, Octa provides commission-free access to various financial markets and a comprehensive suite of services.

In addition to its core business operations, Octa is actively involved in charitable and humanitarian initiatives. It focuses on enhancing educational infrastructure and implementing relief projects to support local communities worldwide. Octa is widely recognized for its competitive spreads, starting from just 0.6 pips on major currency pairs like EUR/USD.

The broker’s commitment to delivering a seamless trading experience is further evident in its user-friendly platforms, which are compatible with popular options like MetaTrader 4 and 5, as well as Octa’s proprietary trading interface. Our comprehensive Octa Forex broker review will make you more informed.

Regulatory Compliance and Safeguards

Octa operates through several regulated entities, each overseen by a specific authority, offering distinct protections and benefits to traders. These include negative balance protection, segregated funds, and compensation schemes. Traders should familiarize themselves with the specific safeguards provided by the entity they choose to trade with, as regulatory requirements may vary across jurisdictions.

Is Octa a Legitimate Broker?

According to our Octa forex broker review, Octa appears to be a legitimate broker. It offers a user-friendly trading experience with competitive spreads, no additional fees, and responsive customer service. The broker states that it provides segregated accounts and negative balance protection to safeguard clients’ interests. However, the lack of third-party account insurance may be a concern for some traders.

Octa has been in operation for over a decade, which is a testament to its credibility and ability to maintain a stable presence in the highly competitive forex industry. The broker’s commitment to transparency and adherence to regulatory standards further bolsters its legitimacy.

Tradable Instruments

Octa provides access to over 230 trading instruments across key asset classes, including:

- 35 currency pairs

- 150 CFDs on stocks

- Five commodity CFDs (including gold and silver)

- 10 index CFDs

- 30 cryptocurrency CFDs

To ensure a secure trading environment, Octa implements rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. Traders are required to provide valid identification documents and proof of address as part of the account opening process, safeguarding the integrity of the platform and protecting the interests of all participants.

Account Types and Trading Platforms

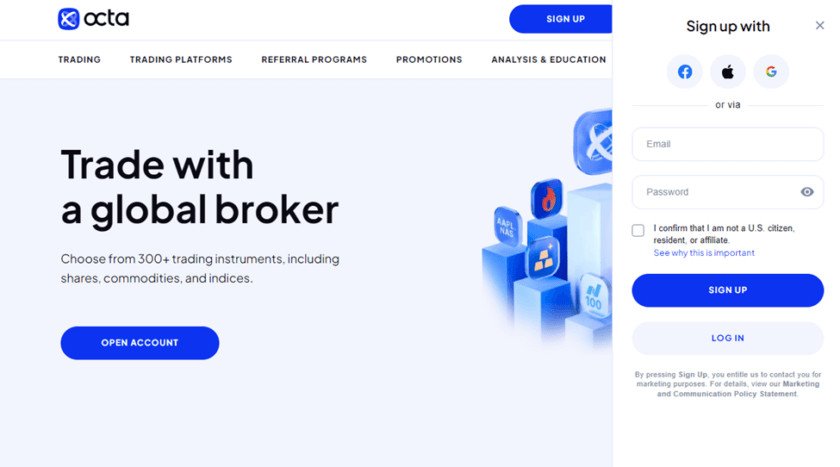

Opening a trading account with Octa is a quick and fully digital process. Traders can sign up on the website, provide personal details, select their preferred account type, and verify their identity before making withdrawals.

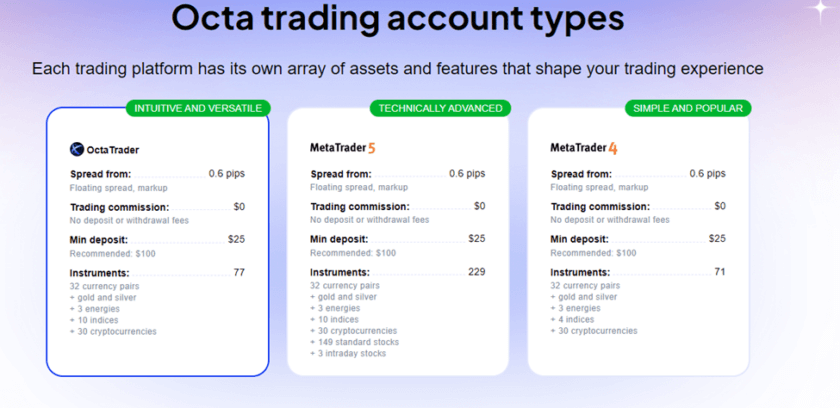

Octa offers three primary account types, each linked to a specific trading platform:

OctaTrader Account

- Web-based platform

- A low minimum deposit of $25

- Competitive spreads from 0.6 pips, commission-free trading

- Leverage up to 1:500

- Access to 80 instruments (forex, metals, energies, indices, cryptocurrencies)

Octa MT5 Account

- MetaTrader 5 platform

- Minimum deposit of $25

- Spreads from 0.6 pips, no commissions

- Leverage up to 1:500

- Access to 277 instruments (forex, metals, energies, indices, cryptocurrencies, stocks, intraday assets)

Octa MT4 Account

- MetaTrader 4 platform

- Minimum deposit of $25

- Spreads from 0.6 pips, no commissions

- Leverage up to 1:500

- Access to 80 instruments (forex, metals, energies, indices, cryptocurrencies)

All Octa accounts are swap-free, making them suitable for Islamic traders adhering to Sharia principles.

Trading Tools and Resources

Octa equips traders with valuable tools to enhance their trading experience, including:

- Economic calendar

- Trading ideas and strategies

- Forex news

- Autochartist for automated analysis and trade signals

- Account monitoring tool to track fellow Octa traders

The broker also offers educational resources, such as beginner-friendly articles, video courses, platform tutorials, live and recorded webinars, and market analysis, to help traders improve their knowledge and skills.

These tools are designed to provide traders with a comprehensive suite of resources to make informed decisions and stay ahead of market developments. The economic calendar, in particular, is a valuable resource for identifying potential trading opportunities based on upcoming economic events and their potential impact on various financial markets.

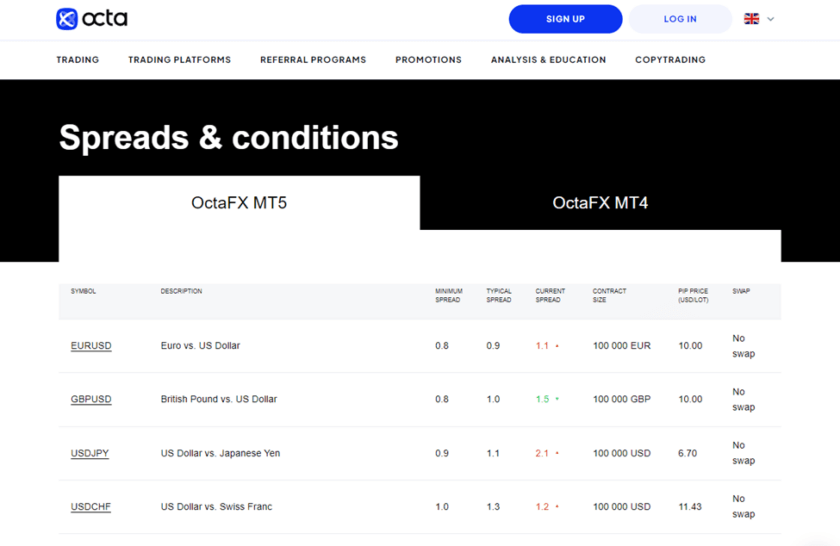

Leverage, Spreads, and Commissions

Octa offers leverage up to 1:500 on forex pairs, with lower ratios for other assets. Spreads are competitive, starting at 0.6 pips on the EUR/USD with an average of around 0.9 pips. The broker does not charge any trading commissions, making it an appealing choice for cost-conscious traders.

Deposits and Withdrawals

Octa facilitates seamless transfers without any commissions or hidden charges. The broker supports a wide array of popular payment methods for deposits and withdrawals, ensuring convenience for traders worldwide.

Bonuses and Promotions

To incentivize and reward its clients, Octa offers a range of bonuses and promotions:

50% Deposit Bonus

Clients can claim a 50% bonus on deposits exceeding $50. This bonus must be activated after making an eligible deposit, and to withdraw the bonus funds, traders are required to trade half the bonus amount in standard lots.

Demo Trading Contests

Octa regularly organizes demo trading competitions where participants can win real money without risking their capital. These contests provide an excellent opportunity for traders to sharpen their skills and potentially earn additional funds.

Customer Support

Octa offers 24/7 customer support through multiple channels, including live chat, email, telephone, WhatsApp, and Telegram. The support team is responsive and assists in multiple languages.

Our Verdict

With its user-friendly platforms, favorable trading conditions, commitment to client support, and licensing in reputable jurisdictions, Octa stands out as an attractive low-cost broker for traders worldwide. Its innovative copy trading platform and swap-free accounts add to its appeal, particularly for Islamic traders. Overall, our Octa Forex Broker review has proved that it is a solid choice for cost-conscious traders who are comfortable with an offshore-regulated broker.

FAQ

Can I trade on the go with Octa?

Absolutely! Octa supports mobile trading through its MetaTrader 4 and 5 apps, as well as its proprietary OctaTrader app, ensuring that traders can access the markets and execute trades from anywhere at any time.

Does Octa offer Islamic/Swap-free accounts?

Yes, all Octa trading accounts are swap-free by default, making them suitable for Islamic traders who adhere to Sharia principles.

How secure are my funds with Octa?

Octa implements rigorous security measures to safeguard clients’ funds, including segregated accounts and negative balance protection.

Can I trade on multiple platforms with Octa?

Yes, Octa offers several trading platform options, including the proprietary OctaTrader, as well as the industry-standard MetaTrader 4 and MetaTrader 5 platforms. Traders can choose the platform that best suits their preferences and trading styles.