Contents

- 1 StarTrader Basics

- 2 Introduction

- 3 Trading Platforms and Features

- 4 Fees and Account Types

- 5 Choosing the Right Account

- 6 Regulation and Security

- 7 Insurance Coverage

- 8 Range of Assets

- 9 Customer Support and Account Opening

- 10 Unique Features

- 11 Payment Methods and Accepted Countries

- 12 Research and Education

- 13 Our Verdict

- 14 Similar Brokers

StarTrader Basics

| 🏛️ Based in | Saint Vincent and Grenadines |

|---|---|

| ⚖️ Regulation | SVG |

| 💰 Minimum Deposit | $50 |

| 💳 Deposit Options | Crypto, VISA, MasterCard, Bank Wire, SticPay, PM, Skrill, Neteller |

| 💳 Withdrawal Options | Crypto, VISA, MasterCard, Bank Wire, SticPay, PM, Skrill, Neteller |

| 📌Open an account | Start Trading With StarTrader |

Introduction

Established in 2012, STARTRADER is a well-known broker that provides access to deep liquidity through fourteen different providers. This allows for tighter spreads and lower trading fees, which can be beneficial for traders who are looking to maximize their profits. In addition to offering popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the company also has its own copy trading service, making it suitable for traders of all levels.

Trading Platforms and Features

The diverse range of trading platform options offered by STARTRADER is one of its most prominent features. Traders can choose between industry-standard platforms like MT4 and MT5 or use the company’s proprietary copy trading service. With this variety available, both beginners and experienced traders should be able to find a platform that suits their needs.

- Deep Liquidity: STARTRADER boasts deep liquidity pools with its fourteen liquidity providers, resulting in tighter spreads and reduced trading costs.

- VPS Hosting: Low-latency execution may be required by certain traders; therefore, VPS hosting is provided by STARTRADER, which is available 24/5 in order to ensure trades are executed without any significant delay.

- Copy Trading: Within the MT4/MT5 platforms themselves, STARTRADER has created a unique copy trading service where successful trader strategies can be followed and replicated directly.

Fees and Account Types

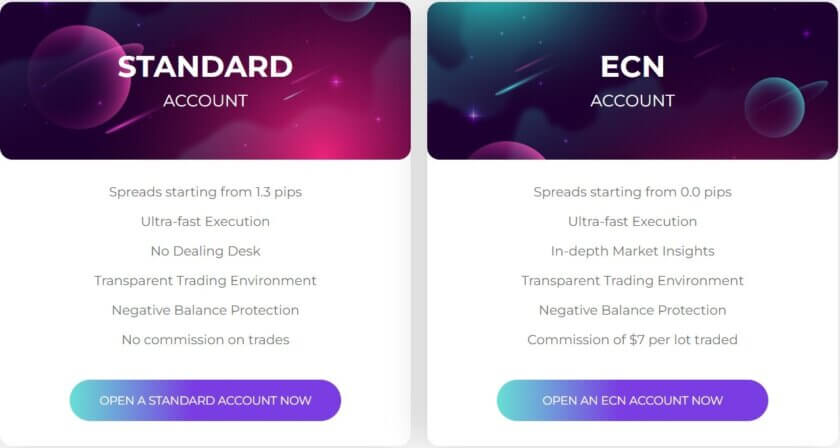

There are two main types of accounts at STARTRADER – standard account without commission fees, ECN account with commission fees charged per lot traded. The Forex spread on Standard account starts from 1.3 pips (which represents $13), while on ECN account raw spread begins at 0.0 pips complemented by $7 commission fee.

In case a position is held overnight swap rates introduced by STARTRADER might either increase or decrease overall trading costs. Internal deposit fees are missing in STARTRADER’s offerings, same as inactivity fees; however, bank wire withdrawal will be charged $20.

Choosing the Right Account

Optimizing your trading experience is heavily dependent on selecting the right account type. For beginners or those who do not want to pay commissions, it is recommended starting with a Standard account. On the other hand, ECN accounts may suit experienced traders better as they provide tighter spreads and require commission payments.

Through STARTRADER’s demo account, one can explore platforms and services at no risk while swap-free trading conditions are available via Islamic accounts for traders who need them.

Regardless of the sought-after account type, STARTRADER ensures secure regulated trading environment, coupled with wide range of tradable assets under competitive conditions.

Regulation and Security

When choosing a broker to trade with, regulation and security should always be top priorities. Being licensed by ASIC (Australia), FSA (Seychelles) and FSCA (South Africa), STARTRADER falls into this category as well.

Such Tier-1 & Tier-2 regulatory bodies enforce stringent financial standards including client funds segregation alongside negative balance protection for retail traders.

Financial Commission membership adds further confidence among its clients. Up to €20,000 compensation per claim can be granted by StarTrader Brokerage Company Limited Liability Partnership. This serves as another safety net for customers’ money.

Insurance Coverage

STARTRADER has partnered with Lloyd’s of London to provide insurance coverage amounting to $1,000,000. In the case of any claim, the broker covers only up to $20,000, while Lloyd’s compensates for amounts over this figure. All existing funds with STARTRADER are automatically protected by this system .

Range of Assets

Although STARTRADER offers a good variety of assets such as 61 currency pairs, 24 commodities, 26 indices and 68 equity CFDs; it lacks some key features. For instance; there are no ETFs listed as tradable instruments. This limits diversification opportunities for those who want to spread their risks across different markets. However, given what is available, most traders should be satisfied with the range provided.

- Forex: Major (major), minor (minor) and exotic (exotic) pairs among other forex products totaling sixty-one in number.

- Commodities: Precious metals like gold & silver plus energy commodities such as crude oil or natural gas (24)

- Indices and Equities: Blue-chip equity CFDs comprising sixty-eight highly liquid stocks alongside twenty-six different indices representing various sectors within economy worldwide.

Customer Support and Account Opening

Email support is available from Monday through Friday around the clock, whereas live chat operates during same hours every day except weekends. Nonetheless; considering rapid growth experienced by STARTRADER in recent years, it may need additional staff so that all customer inquiries can receive prompt replies.

Opening an account with STAR TRADER is seamless and takes seconds. One can register via email address or mobile phone number. Those who already have accounts on social media platforms such as Facebook or Google+ may choose to sign up using these details. Furthermore; there are no time restrictions attached to $100k demo accounts provided by this broker. That means clients can use them for as long as they want without ever having risk real money during practice sessions.

Unique Features

- Proprietary Copy Trading: STARTRADER has integrated its own copy trading service with MT4/MT5 platforms, showing their dedication towards that area of business activity. This feature is especially useful for those traders who wish to emulate successful strategies devised by others.

- VPS Hosting: STAR TRADER offers 24/5 VPS hosting service, which could serve well any trader seeking lightning fast order execution speeds . This is particularly relevant for scalpers and algorithmic traders who rely heavily on technology to compete effectively against other participants.

Payment Methods and Accepted Countries

STARTRADER accepts a range of payment methods .These include such bank transfers, credit/debit cards, STICPAY, Perfect Money, Skrill, Neteller, Omini, SEPA and EPay. But the company does not have a separate section for deposit and withdrawal methods, minimum deposit/ maximum deposit fees and processing time. This can be improved to be more transparent.

STARTRADER does business with clients from all countries except where prohibited by law or regulation such as the United States, Iran and North Korea.

Research and Education

For beginners, STARTRADER offers educational materials, including videos and well written articles on different trading topics. However, their researches offerings are limited to short videos and articles, which give a basic overview of market conditions.

Despite these shortcomings, STARTRADER’s resources can serve as good starting points for novice traders. They also host few Arabic webinars for their non-English speaking customers.

Our Verdict

If you want deep liquidity, low-latency trading and versatile trading platforms, then STARTRADER is worth considering. The asset diversity and customer support may need some improvement.

Nevertheless, the fact that it has strong regulations in place, coupled with features like VPS hosting and proprietary copy trading, makes it useful for both newbies and experienced traders.

To sum it up, STARTRADER has created an atmosphere of competitiveness within its trading environment, while still focusing on security measures through regulation. This gives confidence among traders about safety their funds.