| 🏛️ Based in | Limassol, Cyprus |

|---|---|

| ⚖️ Regulation | FSCA |

| 💰 Minimum Deposit | $250 (100000 Naira) |

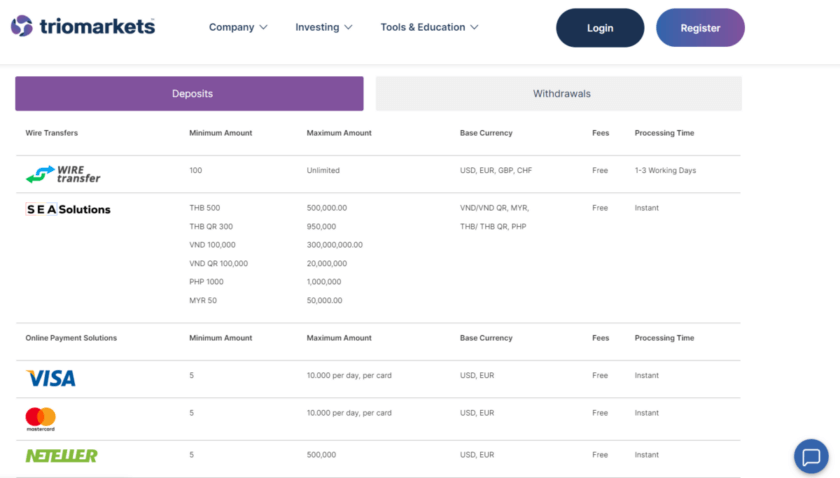

| 💳 Deposit Options | VISA, MasterCard, Bank Wire, Neteller, Skrill. |

| 💳 Withdrawal Options | VISA, MasterCard, Bank Wire, Neteller, Skrill. |

| 📌Open an account | Start Trading with TrioMarkets |

Contents

- 1 Our Opinion

- 2 TrioMarkets Regulation and Safety

- 3 TrioMarkets: Legit or Scam?

- 4 TrioMarkets Trading Instruments

- 5 TrioMarkets Accounts

- 6 Trading Tools

- 7 Leverage, Spreads and Commissions

- 8 Deposits and Withdrawals

- 9 Account Registration

- 10 Bonuses and Promotions

- 11 Trading Platforms

- 12 Education and Research

- 13 Our Verdict

- 14 FAQs

- 15 Similar Brokers

Our Opinion

TrioMarkets has established itself as a notable player in the global forex and CFD trading market since its inception in 2020. Operating from Saint Vincent and the Grenadines, this broker offers a diverse range of trading instruments and competitive conditions that cater to both novice and experienced traders worldwide.

While TrioMarkets provides an attractive trading environment with its low minimum deposit and high leverage options, potential clients should be aware of the limitations in regulatory oversight compared to brokers based in more stringent jurisdictions. However, the broker’s commitment to transparency and client fund protection measures helps to mitigate some of these concerns.

TrioMarkets Regulation and Safety

TrioMarkets operates under the regulatory framework of the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). While this jurisdiction is known for its more relaxed approach to broker regulation compared to stricter bodies like the UK’s FCA or Australia’s ASIC, TrioMarkets adheres to several self-imposed standards to ensure client safety and fair-trading practices.

Client Fund Safety

To protect client funds, TrioMarkets implements the following measures:

- Segregation of client funds from company operational accounts

- Partnerships with reputable banks for fund storage

- Regular internal audits to ensure compliance with fund-handling procedures

- Negative balance protection to prevent clients from losing more than their account balance

While these measures provide a level of security, traders should note that the lack of participation in a compensation scheme means there’s no guaranteed protection against broker insolvency.

TrioMarkets: Legit or Scam?

Based on our comprehensive analysis, TrioMarkets emerges as a legitimate broker in the forex and CFD trading world. Several key factors contribute to this assessment, including the broker’s commitment to transparency in company information and trading conditions, a track record of positive client feedback, and the absence of major regulatory infractions or scandals. Additionally, TrioMarkets offers robust trading platforms and tools, further solidifying its credibility in the market.

However, it’s crucial to emphasize that the world of online trading carries inherent risks, and no broker is entirely without potential drawbacks. As such, we strongly advise all traders to exercise due diligence and caution before committing funds to any broker, including TrioMarkets. This includes thoroughly researching the broker’s background, understanding the risks associated with trading, and starting with a small investment to test the broker’s services firsthand.

TrioMarkets Trading Instruments

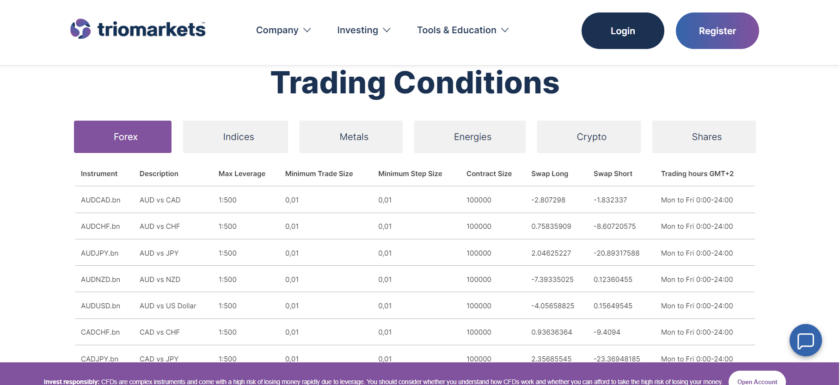

TrioMarkets offers a diverse portfolio of over 200 tradable instruments across multiple asset classes:

- Forex: 50+ currency pairs including majors, minors, and exotics

- Commodities: Gold, silver, oil, and agricultural products

- Indices: Major global stock indices

- Stocks: CFDs on popular US and European stocks

- Cryptocurrencies: Bitcoin, Ethereum, and other major altcoins

This wide selection allows traders to diversify their portfolios and take advantage of opportunities across different markets.

TrioMarkets Accounts

TrioMarkets offers a range of account types designed to cater to traders with varying levels of experience, capital, and trading preferences. These account types are structured to provide increasingly favorable trading conditions as the minimum deposit increases. Here is a table showcasing the account types;

| Type | Spreads | Min. Deposit | Max. Leverage | Commission |

|---|---|---|---|---|

| Basic | From 2.4 pips | $100 | 1:500 | $0 |

| Standard | From 1.4 pips | $5,000 | 1:500 | $0 |

| Premium | From 1.1 pips | $25,000 | 1:500 | $0 |

| VIP | From 0.0 pips | $50,000 | 1:500 | $4 per lot |

Basic Account

This is an excellent entry-level option for new traders worldwide. It features an average spread of 2.4 pips with no commissions. The account offers high leverage of up to 1:500, allowing traders to control larger positions with smaller capital. The minimum deposit is accessible at $100, and the base currency is USD. Traders should note that the Basic Account is exclusively available on the MT4 platform.

Standard Account

Designed for intermediate forex traders, the Standard Account provides improved trading conditions. It offers a competitive average spread of 1.4 pips and maintains a commission-free structure. Like the Basic Account, it provides high leverage up to 1:500. The minimum deposit requirement is $5,000, with USD as the base currency. This account is also only available on the MT4 platform.

Advanced Account

Catering to more experienced traders, the Advanced Account offers enhanced features. It boasts a tight average spread of 1.1 pips without any commissions. The account maintains the high leverage option of up to 1:500, allowing for potentially larger trades. A minimum deposit of $25,000 is required, and USD serves as the base currency. As with other account types, the Advanced Account is exclusively offered on the MT4 platform.

Premium Account

The Premium Account is tailored for professional and high-volume traders. It stands out with its raw spread starting from 0.0 pips, although it does include a $4 commission per side. The account offers the same high leverage of up to 1:500 as other account types. It requires a substantial minimum deposit of $50,000, with USD as the base currency. Like all other account types, the Premium Account is only available on the MT4 platform.

Islamic swap-free accounts are available upon request for all account types, catering to traders who follow Islamic finance principles. This diverse range of options allows traders globally to select an account that aligns with their experience level, trading style, and capital availability. While the minimum deposits for higher-tier accounts are considerable, the combination of tight spreads and high leverage across all account types offers potential value for traders of various levels.

Trading Tools

TrioMarkets equips traders with a range of tools to enhance their trading experience:

- Advanced charting package with multiple indicators

- Economic calendar with real-time updates

- Trading signals and market analysis from in-house experts

- Risk management tools including stop-loss and take-profit orders

- Free VPS hosting for eligible accounts

Leverage, Spreads and Commissions

TrioMarkets offers a competitive trading environment with conditions designed to appeal to a wide range of traders. The broker provides high leverage of up to 1:500 across most instruments, allowing traders to potentially magnify their market exposure. Floating spreads start from as low as 0.0 pips on ECN accounts, while standard accounts enjoy commission-free trading.

For those opting for ECN accounts, a $5 per lot round-turn commission applies. While these conditions, particularly the high leverage, can enhance profit potential, they also increase risk. Therefore, TrioMarkets emphasizes the importance of cautious leverage use, advising traders to align their trading decisions with their individual risk tolerance and experience level.

Deposits and Withdrawals

TrioMarkets supports various payment methods for deposits and withdrawals.

Withdrawal processing times vary by method, ranging from 1-3 business days for e-wallets to 5-7 business days for bank transfers. The broker charges no fees for deposits, but withdrawal fees may apply depending on the method and amount.

Account Registration

Opening an account with TrioMarkets is a straightforward process:

- Visit the TrioMarkets website and click “Open Account”

- Fill out the registration form with personal details

- Choose your account type and base currency

- Upload required verification documents

- Fund your account and start trading

The broker typically processes account applications within 24-48 hours.

Bonuses and Promotions

TrioMarkets occasionally offers promotional bonuses to new and existing clients. These may include:

- Welcome bonuses for new depositors

- Deposit match bonuses

- Loyalty rewards for regular traders

Traders should carefully review the terms and conditions of any bonus offers, as they often come with specific trading volume requirements.

Trading Platforms

TrioMarkets provides access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms:

- Desktop versions for Windows and Mac

- WebTrader for browser-based trading

- Mobile apps for iOS and Android devices

Both platforms offer advanced charting, multiple order types, and support for automated trading through Expert Advisors (EAs).

Education and Research

TrioMarkets supports trader development through various educational resources:

- Video tutorials covering platform usage and trading strategies

- Regular webinars hosted by market experts

- E-books on forex trading fundamentals

- Daily market analysis and trade ideas

- Demo accounts for risk-free practice

These resources cater to traders of all experience levels, from beginners to advanced.

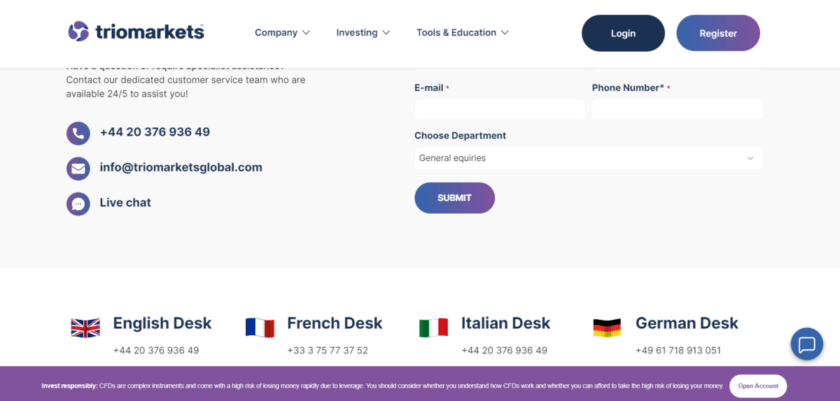

Customer Support

TrioMarkets offers multi-lingual customer support through several channels:

The support team is generally responsive and knowledgeable about trading-related queries.

Our Verdict

TrioMarkets presents a mixed package for global traders. On the positive side, the broker offers a wide range of tradable assets, competitive trading conditions, and a solid suite of trading tools and educational resources. The low minimum deposit and high leverage options make it accessible to traders with varying capital levels.

However, the regulatory environment in Saint Vincent and the Grenadines may not provide the same level of oversight and protection as more stringently regulated jurisdictions. This factor should be carefully considered, especially by risk-averse traders.

TrioMarkets could be a suitable option for traders who prioritize flexible trading conditions and a diverse asset portfolio, and who are comfortable with the level of protection offered. As always, we recommend thorough due diligence and starting with a small investment to test the broker’s services before committing larger sums.

FAQs

TrioMarkets is registered and regulated by the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA).

The minimum deposit for a Silver account with TrioMarkets is $100.

Yes, TrioMarkets provides negative balance protection to its retail clients, ensuring that traders cannot lose more than their account balance.

Ready to start trading? Sign up for an online trading account with TrioMarkets here. Looking for more information? Check out our full forex broker list.

Similar Brokers

Broker | |||||

Review | |||||

CopyTrading | |||||

Platforms |