One of the more difficult concepts within Technical Analysis is grasping the premise of support and resistance. There are numerous ways to identify these levels, and even after identified, there are a plethora of ways of integrating and trading with them.

In this article, we’re going to show you three ways that traders can properly integrate these levels.

Risk Management/Stop Placement

While this may be the least ‘exciting’ of the three ways to integrate support and resistance, this is also probably the most important.

Stop-loss orders help traders prevent blowing up their entire accounts on just one or two bad trade ideas. We’ve looked at the importance of stops, and further, risk management in numerous of our previous articles. Sloppy risk management is The Number One Mistake that Forex Traders Make, and this is also the Top Trading Mistake.

Support and resistance can help traders to define their risk amounts for any individual position.

Let’s say that a trader wants to buy in a range, and if that range doesn’t continue, they want to close out the position quickly in an effort to mitigate the loss.

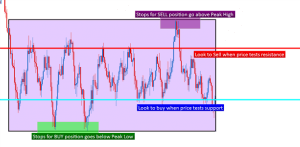

In this case, it makes sense to place the stop for the long position below support so that once support becomes violated, the stop-loss can close the position and the trader can look to avoid taking a larger loss.

Support and resistance can help with stop placement

This can also work for reversal plays. If a trader is looking to buy a bullish reversal, they can look to the low that was established before the reversal began; and they can place their stop there. This way, if the reversal doesn’t pan out, and if prices do continue moving in the previous trend-side direction, the position can be closed as traders look to mitigate their loss.

The exact opposite would be the case for short positions, with traders looking to place stops above resistance so that should the market continue rising; the short position can be closed with a minimum of a loss.

Determining a Market’s Condition

We’ve all heard it since we were young: Buy low, and sell high.

If only matters were that simple.

What constitutes ‘high’ and what constitutes ‘low?’ After all, these are very relative matters, and low in a market today might be sky-high a week from now.

This is where support and resistance come into play, and this is why finding strong, confluent levels can be so beneficial.

Think about why support or resistance may come into a market: The only real reason is due to an influx of buyers or sellers at a particular price level.

Let’s say that we’re expecting support at a price of 1.6750 on GBPUSD; which is a psychological level in the currency pair. As prices move lower towards this expected support level, buyers begin coming into the market in anticipation of a future support level being so close. As prices move closer and closer to this level of support, more and more buyers notice this ‘perceived value’ in GBPUSD and they also look to enter in long cable positions. The exact low of the move is considered a ‘price action swing.’

Eventually, the number of buyers in GBPUSD outstrips the number of sellers, and this is what creates a reversal in the market as the higher level of demand takes over smaller level of supply. This is how price action works, and it happens in short and long-terms alike.

Price action will also help traders see support and resistance in trending markets and ranging markets as well.

In trending markets, prices will generally make ‘higher-highs’ and ‘higher-lows,’ or ‘lower-lows’ and ‘lower-highs,’ while ranging markets will generally display more stable levels of support and resistance. The example below in USDJPY shows both of these types of environments on the same chart.

Current price relationship with Support/Resistance can define the market’s condition

But what if the market isn’t displaying a bias?

If the market is ranging, traders can still utilize price action to look at risk-efficient ways of entering trades and positions.

In the image below, we illustrate how traders can use price action along with support and resistance to build a range-strategy in a market devoid of any significant trends:

Price action can also be used to enter trades in ranging markets.

Before employing any of the mentioned methods, traders should first test on a demo account. The demo account is free; features live prices, and can be a phenomenal testing ground for new strategies and methods.