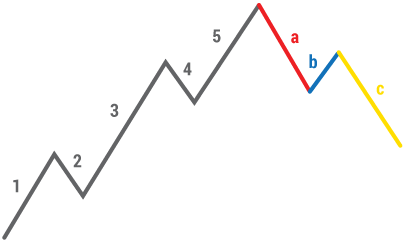

According to the Elliott Wave Theory, the market moves in repetitive sequences of upswings and downswings. A trending market is made up of a motive phase (made up of 5 waves) and a corrective phase (made up of 3 waves). If the market was in an uptrend, the Elliott Wave would look like this:

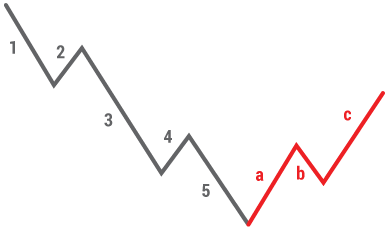

In a downtrend, it would look like this:

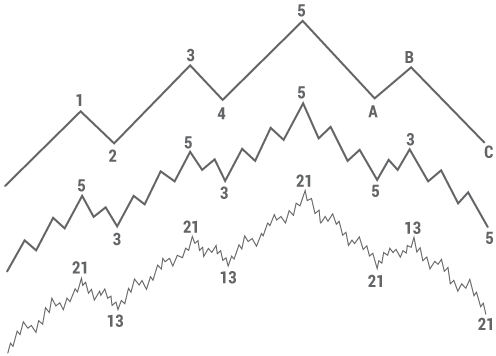

These patterns can be found in any time frame and in smaller and smaller degrees. This means that each larger wave is made up of smaller sub-waves. For example, wave 1 of a 5-wave sequence can itself be broken down into 5 waves.

As you can see, each wave can be broken down to sub waves. The Elliott Wave Theory categorizes these waves in order of the largest to the smallest:

- Grand Supercycle

- Supercycle

- Cycle

- Primary

- Intermediate

- Minor

- Minute

- Minuette

- Sub-Minuette

Rules and Guidelines

Certain observations can be made in the Elliot Wave Theory which give us some tips when trying to analyze the market using this model.

In the motive phase, three basic rules must be observed:

Wave 3 is never the shortest wave of the three impulse waves 1, 3, and 5.

Wave 4 never enters the price territory of wave 1.

Wave 2 never retraces beyond the start of wave 1.

A common observation of waves 2 and wave 4 is that they make alternate patterns. For example, if wave 2 makes a sharp move, then wave 4 will make a mild move, and vice versa.